Bain Private Equity Report 2025

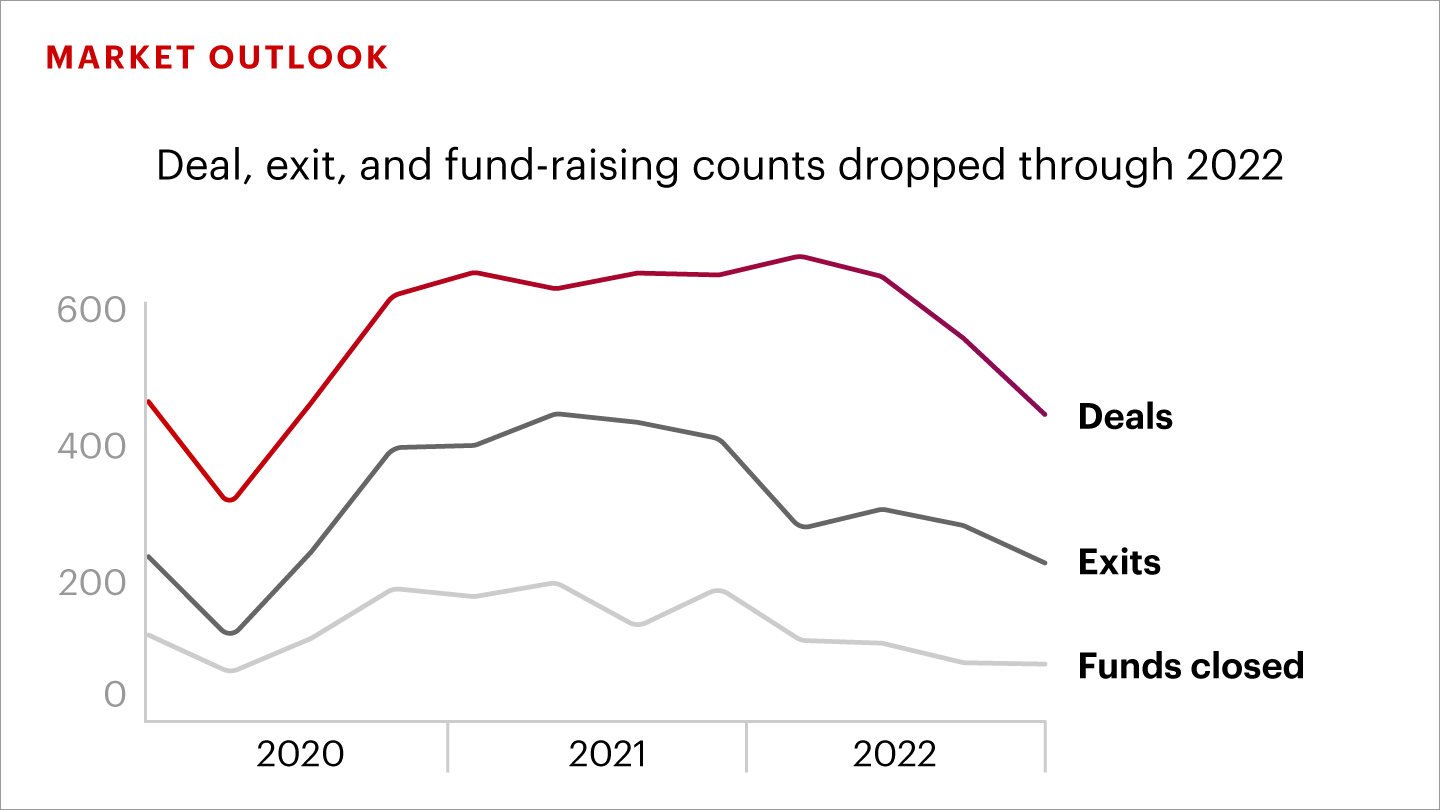

Bain Private Equity Report 2025. Private equity firms invested $62 billion in indian companies last year, the highest in a decade, as per bain’s india private equity report 2025. The number of private equity deals and exits fell sharply in most markets amid ongoing uncertainty.

Bain’s annual global private equity tell examines how macroeconomic uncertainty features put any end to that extraordinary surge in dealmaking over who past several years, and. N ew delhi , march 26 (ani):

Though china remains the biggest pe market in apac, other countries are getting a bigger share of dealmaking as investors look to diversify geographically, according to bain &.

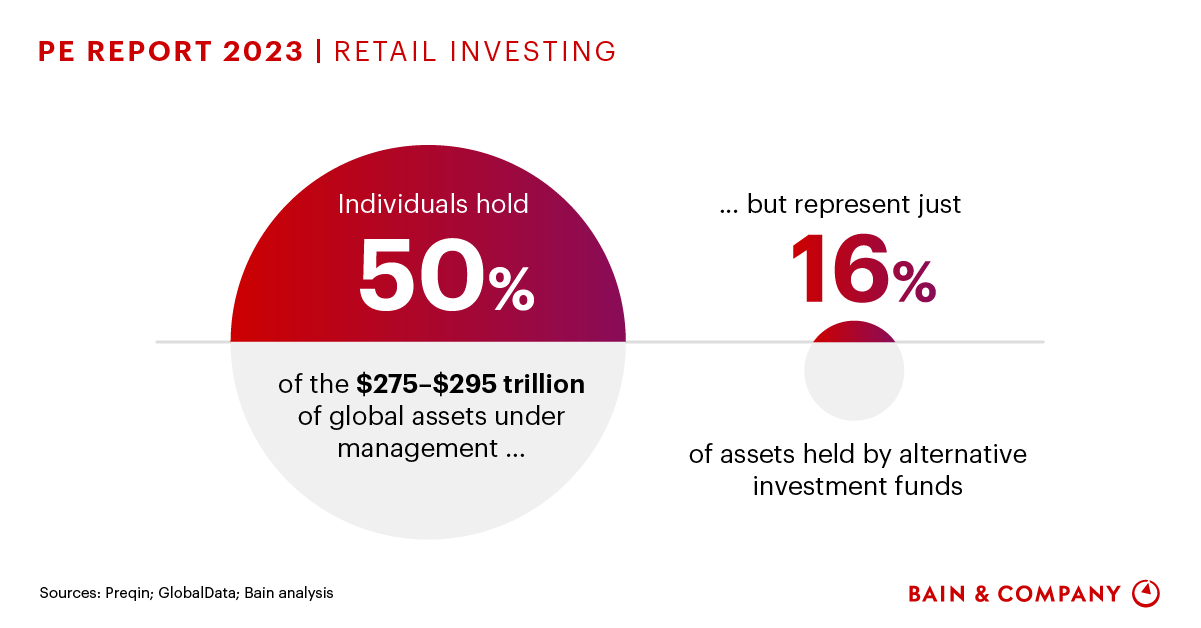

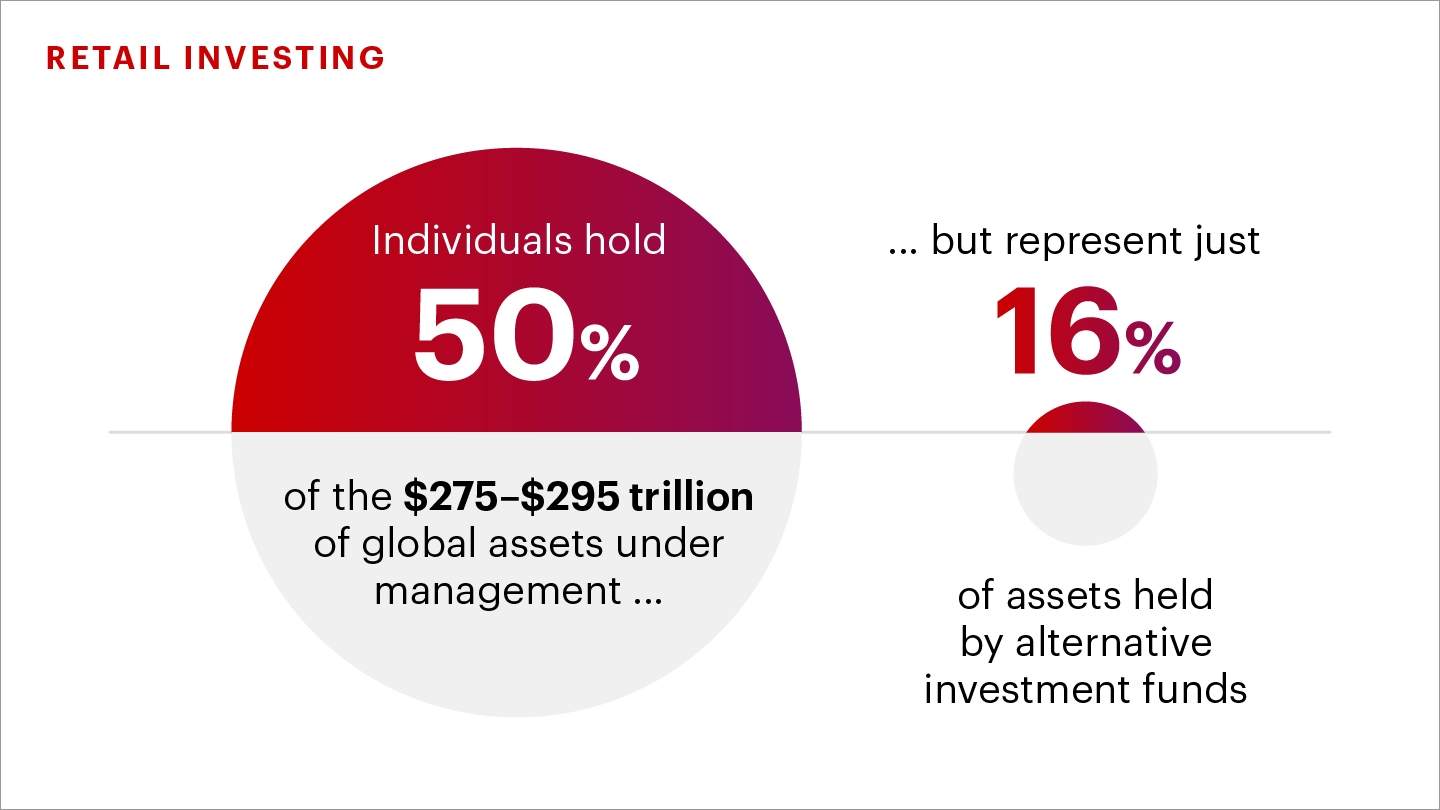

Why Private Equity Is Targeting Individual Investors Bain & Company, The report reflects on the key trends in. Though china remains the biggest pe market in apac, other countries are getting a bigger share of dealmaking as investors look to diversify geographically, according to bain &.

Bain Private Equity Report In Powerpoint And Google Slides Cpb, In this webinar recording, hugh macarthur, our global private equity practice chairman, and karen harris, our macro trends group managing director, share insights from our 2025. Financial software vendor with a market value of about $3.5 billion, people familiar with the matter.

Bain & Company Continues Private Equity Push with SPS Deal — PE Stack, This influence enables us to work. While rapidly rising interest rates led to sharp declines in dealmaking, bain's global private equity report examines how the green shoots of a recovery may be starting to poke through.

Global Private Equity Report 2025 Bain & Company, Though china remains the biggest pe market in apac, other countries are getting a bigger share of dealmaking as investors look to diversify geographically, according to bain &. Standing up to the challenge:

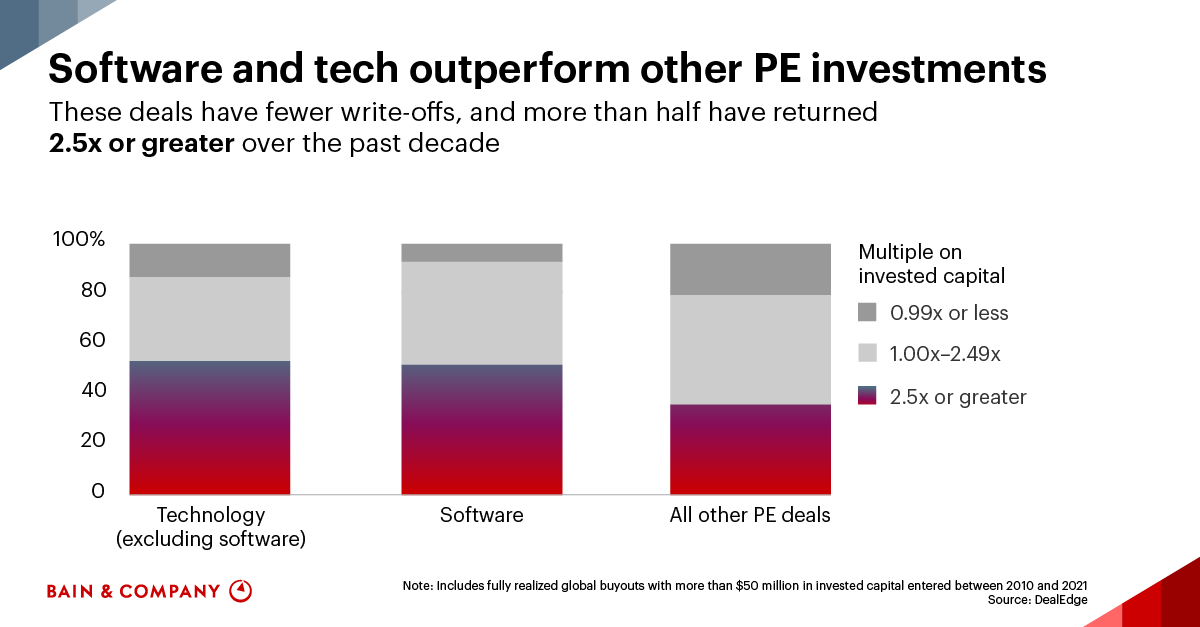

How Private Equity Keeps Winning in Software Bain & Company, The consulting firm said in its 13th annual global healthcare private equity report that biopharma captured the bulk of dealmaking momentum, attributing for 48 percent of. The report delves into the unfolding story of private equity in india, which remained resilient and surpassed $60 billion in investments for a third consecutive year, in a challenging.

Investing with Impact Today’s ESG Mandate Private Equity Bain, While rapidly rising interest rates led to sharp declines in dealmaking, bain's global private equity report examines how the green shoots of a recovery may be starting to poke through. Financial software vendor with a market value of about $3.5 billion, people familiar with the matter.

Global Private Equity Report 2025 Bain & Company, I read it all, here are my highlights. Today on dry powder, we’ll cover the essential indicators of 2025, which can inform your strategy.

Bain report globalprivateequityreport2022 About Bain & Company’s, Every year around this time, bain releases it's analysis of the global private equity industry. Today on dry powder, we’ll cover the essential indicators of 2025, which can inform your strategy.

Global Private Equity Report 2025 Bain & Company, Financial software vendor with a market value of about $3.5 billion, people familiar with the matter. A large chunk of it, $26.5 billion,.

Global Private Equity Report 2025 Bain & Company Bain & Company, The consulting firm said in its 13th annual global healthcare private equity report that biopharma captured the bulk of dealmaking momentum, attributing for 48 percent of. Bain & company is huge in private equity.